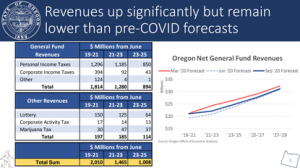

FoFF visited Salem virtually during the September Legislative Days. The big surprise was that Oregon revenue is up significantly, but still lower than pre-Covid forecasts. In the lead up to Legislative Days, a dire $4 billion budget shortfall was anticipated. Mark McCMullen, the State Economist, revealed the Office of Economic Analysis estimates are $2 billion higher than previously expected. You can see the full Revenue Forecast here. FoFF’s understanding after watching the Revenue Committee is that the increase came from unexpectedly large 2019 tax return payments from high-income earners that hadn’t been filed before the last Revenue forecast; the federal Covid-19 relief funds; and sadly, the fact that there is so much income disparity in Oregon—meaning that even though lower socio-economic sectors have been hit incredibly hard, since they don’t generate much tax revenue (and the higher socio-economic sectors are doing relatively well, if not better than usual), the state’s tax revenue hasn’t been as impacted as gravely as initially thought. Budget cuts will still happen, but here is to hoping they won’t be as severe, and that Oregon finds ways to address the income disparity highlighted in the revenue forecast.

Tax revenues are up in Oregon despite high unemployment and “a Great Recession-sized hole,” according to the state revenue forecast released Wednesday by the Oregon Office of Economic Analysis. The forecast also predicts Oregon’s labor market will return to health during the summer of 2023. The state had seen record low unemployment prior to imposition of COVID-19 restrictions in March. (OOEA)

If it is hard to view the graph, you can find it here.